Maximising the potential of the CRA from design to implementation

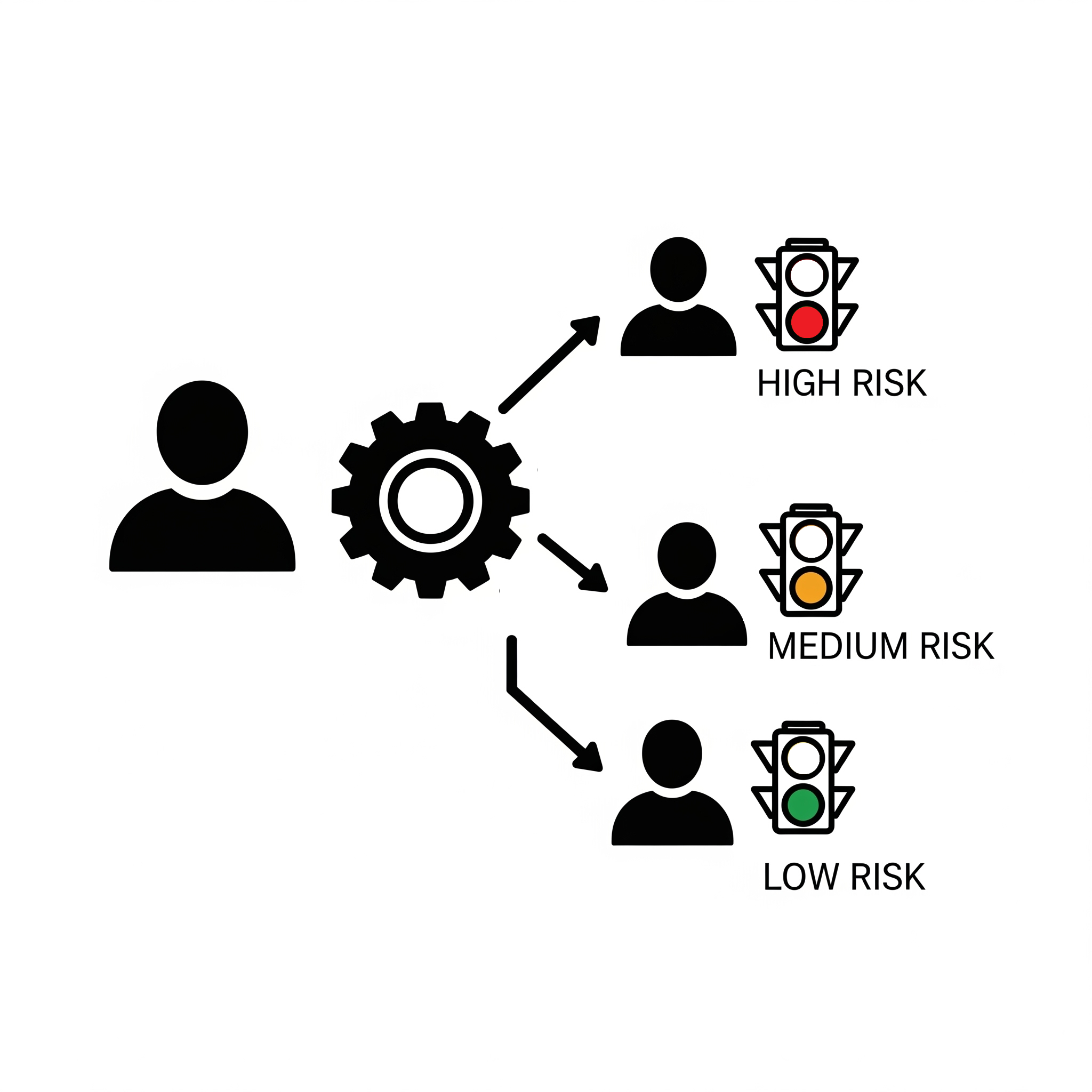

The ability to effectively assess the risk that a customer presents from a money laundering and terrorist financing perspective is a central element of Customer Due Diligence obligations. However, firms often fall into the trap of treating customer risk assessment (CRA) as merely a regulatory requirement, and can find themselves with a CRA which is not fit for purpose.

Will your sanctions screening systems withstand FCA scrutiny?

In this post, we set out the steps firms must take to be ready to respond to testing. For tech-savvy financial institutions, in-house testing of sanctions screening is relatively straightforward and can help to ensure you’re ready to respond when the FCA call.

Is your Transaction Monitoring system fit for purpose?

Malverde have supported many clients to design, implement and optimise their TM systems. Through this experience we have developed the following checklist to support clients in reviewing the suitability of their system to manage their unique risks and avoid large inefficiencies and costs.

Scam reimbursement requirements – preparing for October

What should your firm be doing to prepare for the October deadline?

Mules – the ass-end of the problem

When it comes to APP fraud, the industry’s primary focus is currently on ‘breaking the spell’ cast on victims. However, its mules and the criminal organisations behind them that are the perpetrators of these crimes. More action needs to be taken to address the ‘ass-end’ of the problem if we are going to prevent APP fraud!

Fraud prevention - new minimum standards for preventing and responding to scams

The PSR has revealed a set of new minimum standards for preventing and responding to scams - what is changing?

Malverde is launched

After many of hours of planning and preparing, we’re delighted to formally launch Malverde.